us exit tax percentage

Finally here is Ms answer. An expatriation tax is a tax on someone who renounces their citizenship.

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

International Arrival Tax 3 1970.

. As the percentage of this amount that you must pay as part of your exit tax is based on your marginal tax rates it is likely to be different for everyone currently it cannot be any higher than 238. This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax. Youre going to get taxed by the IRS on that US1 million gain.

The term expatriate means 1 any US. Citizenship or green card. In direct answer to Ms question you will pay tax once and once only when you exit the United States.

Eligible deferred compensation items. This is called citizenship-based taxation. Different rules apply according to.

Currently net capital gains can be taxed as high as 238 including the net. One system of estate and gift taxation applies to US citizens and. Legal Permanent Residents is complex.

The Foreign Earned Income Exclusion threshold for 2018 was 103900. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. If you have US5 million in gold that you bought at an average price of US1300 per ounce and the price of gold the day you expatriate is US1200 per ounce then you have no unrealized gain and wont owe any Exit Tax.

The United States has a unified gift and estate tax system that applies to gifts made during life and bequests made at death. The exit tax and the inheritance tax. It rises to 12200 for 2019 and 12400 for 2020.

In a few cases the tax will be imposed by 30 withholdings on payments to you forever and ever. These rules and exceptions present some exit planning opportunities. The exit tax is essentially the application of US income tax on the portion of that phantom gain that exceeds US690000 as of 2015 as.

Other countries have exit taxes too. For 2021 the highest estate and gift tax rate is 40 percent. The term expatriate means 1 any US.

Expatriation from the United States. As a result of this election no subsequent distribution from the trust to the covered expatriate will be subject to 30 percent withholding Notice 2009-85 7D. The expatriation tax consists of two components.

It rises to 105900 for 2019 and 107600 for 2020. Frequent Flyer Tax 2 750. Passenger Ticket Tax 1 domestic 800.

1 737 205 6687. The Child Tax Credit remains 2000 for all three years with the refundable part that many expat parents can claim as a payment also staying the same at 1400 per child. In the United States the expatriation tax provisions under Section 877 and Section 877A of the Internal.

Exit Tax and Expatriation involve certain key issues. Your average net income tax liability from the past five years is over a set amount 171000 for 2020 You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Resident status for federal tax purposes.

The United States is unique however in tying its exit tax to a change in visa or citizenship status. Cargo Waybill Tax 1b domestic 500. These simplified single-issue examples are only for clarity.

Flight Segment Tax 1a domestic 450. Citizens who have renounced their citizenship and long-term residents as defined in IRC 877 e who have ended their US. If the payer of the deferred compensation is a US citizen and the taxpayer expatriating has waived the right to a lower withholding rate clarification needed then the covered expatriate is charged a 30 withholding tax on their deferred compensation.

International Departure Tax 3. Planning around the exit tax. Federal income tax rates range from 10 percent to 37 percent.

Content updated daily for tax exit. If the covered expatriate does not meet the aforementioned criteria then the deferred compensation is taxed as income based on the. The Basics of Expatriation Tax Planning.

In most cases it will be in one giant lump in the year that you give up your US. 6 NovemberDecember 2020 Pg 60 Gary Forster and J. If the IRS can rely on tax withholding rules to assure full collection of income tax the covered expatriate pays tax at a 30 rate on US.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Ad This is the newest place to search delivering top results from across the web. Federal income tax rates range from 10 percent to 37 percent.

Commercial Jet Fuel Tax domestic flights not continuing ex-USA 43. Citizenship or long-term residency by non-citizens may trigger US. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status.

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

Renouncing Us Citizenship Expat Tax Professionals

Exit Tax In The Us Everything You Need To Know If You Re Moving

Renounce U S Here S How Irs Computes Exit Tax

A Uk Company Is A Good Solution For Digital Nomads Tax Consulting Uk Companies Corporate Tax Rate

What Are The Us Exit Tax Requirements New 2022

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

What Is Expatriation Definition Tax Implications Of Expatriation

The Exit Tax For Out Of Staters Nj Com

New Homes For Sale In Riverside Jurupa Valley California New Homes In Riverside And Jurupa Valley Canter New Homes For Sale Valley View New Home Builders

1040 Income Tax Cheat Sheet For Kids Income Tax Consumer Math Financial Literacy

Investing Archives Napkin Finance Investing Personal Finance Budget Finance Investing

What Are The Us Exit Tax Requirements New 2022

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Exit Tax Us After Renouncing Citizenship Americans Overseas

Green Card Exit Tax Abandonment After 8 Years

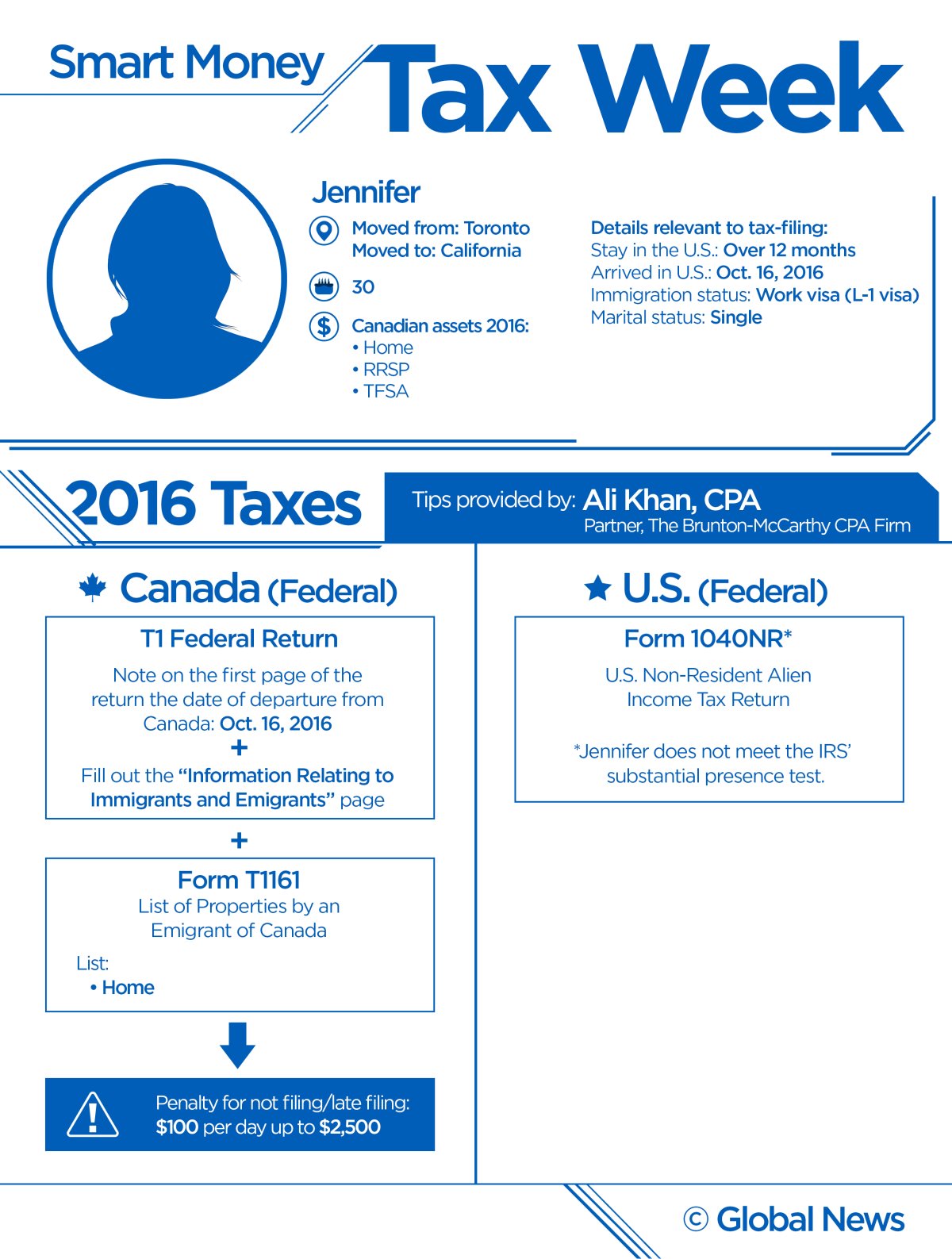

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca